GLOBAL SHIFT TOWARDS SUSTAINABLE ENERGY SOURCES

The world's population is steadily increasing[4], leading to a heightened demand for electricity. However, in response to the climate change crisis and the rising cost of fossil fuels, there is a growing emphasis on decarbonization through the utilization of sustainable energy resources to power the electricity sector. Recent policy initiatives further underscore the global commitment to transitioning towards sustainable energy sources.

In 2019, the State of California, United States of America enacted legislation mandating that new residential constructions up to three stories high include rooftop solar panels, demonstrating a proactive dedication to advancing sustainable and renewable energy practices within the state's residential sector.[5] This move aims to enhance energy efficiency, reduce reliance on traditional power sources, and contribute to broadening environmental mitigation goals. It aligns with California's overarching efforts to lead in renewable energy adoption, reflecting a commitment to fostering a greener and more sustainable future in the construction and housing sector.

Similarly, on February 7, 2023, Minnesota Gov. Tim Walz signed a clean energy bill into law, requiring the state's utilities to derive 100% of their electricity from carbon-free energy sources by 2040.[6]

According to the World Economic Forum[7], Europe has made substantial progress in transitioning towards renewable energy sources for electricity generation over the last decade. In 2011, fossil fuels accounted for just under half of the EU's electricity production, with renewable energy sources contributing only 18%. Fast-forward to 2022, and wind and solar power alone generated 22% of EU electricity, surpassing natural gas at 20% and coal at 16%. Hydro and nuclear power still constitute the primary sources of electricity production at around 32%. This significant shift highlights a growing recognition of the importance of clean energy in mitigating environmental impact and fostering a more sustainable future on both regional and global scales.

CURRENT ENERGY LANDSCAPE IN NIGERIA

Nigeria predominantly relies on thermal and hydroelectric power for its electricity generation, boasting an installed capacity of about 12,522 MW.[8] According to data from the Nigerian Electricity Regulatory Commission (NERC)[9], the unbundling of the Power Holding Company of Nigeria (PHCN) has led to a diverse energy mix in the country. Generation companies resulting from this process, such as Afam, Sapele, Egbin, Ughelli (gas-powered plants), and Kainji, Jebba, Shiroro (hydroelectric facilities), contribute a total of 5,048 MW. While gas-based plants are fully privatized, hydroelectric ones operate under long-term concessions, showcasing varied ownership and management approaches. This diverse landscape reflects Nigeria's commitment to harnessing different energy sources for electricity generation, with the involvement of private entities expected to enhance efficiency, foster innovation, and promote sustainable energy practices.

In the current Nigerian electricity generation sub-sector, 23 grid-connected generating plants collectively offer an installed capacity of 10,396 MW. The available capacity is 6,056 MW, with thermal-based generation contributing significantly, boasting an installed capacity of 8,457.6 MW (available capacity of 4,996 MW). Hydropower also plays a vital role, with a total installed capacity of 1,938.4 MW (available capacity of 1,060 MW). This framework incorporates a mix of privatized Generation Companies (GenCos), Independent Power Producers (IPPs), and generating stations under the National Integrated Power Project (NIPP).[10]

Furthermore, the NERC has introduced a Regulation on embedded generation, enabling power generation plants, including those utilizing renewable energy sources, to connect directly to and evacuate through a distribution network.[11]

The above highlights Nigeria's current electricity sources, emphasizing the diverse energy mix resulting from the unbundling of PHCN. The presence of gas-powered and hydroelectric plants, each with distinct privatization or concession structures, underscores the nation's commitment to utilizing varied energy sources. The inclusion of thermal-based generation and hydropower, contributing significantly to the total installed capacity, illustrates the multifaceted nature of the electricity generation sector in Nigeria. The integration of private entities and regulatory support for embedded generation indicates a strategic and evolving transition toward a resilient and diversified energy sector, aligning with both immediate electricity needs and long-term sustainability goals.

LEGISLATION AND FRAMEWORK SUPPORTING RENEWABLE ENERGY DEVELOPMENT IN NIGERIA

As Nigeria actively seeks to enhance its renewable energy sector, several laws and policies have been enacted to facilitate its growth.

THE ELECTRICITY ACT 2023

The Electricity Act (“The Act”) outlines various objectives, one of which is to establish a framework that stimulates the development and utilization of renewable energy sources. The Act aims to create an enabling environment to attract investments in renewable energy, with the ultimate goal of increasing the contribution of renewable energy to the overall energy mix.[12] Section 80 of the Act specifically emphasizes the "promotion of generation from renewable energy," showcasing a strong commitment to fostering the use of renewable energy sources. The Act imposes an ongoing obligation on the Commission and Promotion of the Independent System Operator (ISO) to actively encourage and promote electricity generation from renewable sources.

When issuing generating licenses, the Commission (NERC) is mandated to promote various forms of renewable energy generation, including embedded generation, hybridized generation, co-generation, and electricity generation from sources like solar energy, wind, small hydro, biomass, and other renewables defined in the Act or that may be developed in the future. This legislative provision underscores a proactive stance towards diversifying the energy mix and integrating sustainable practices into the electricity generation sector in Nigeria.

Furthermore, the Act[13] outlines the establishment of an Integrated National Electricity Implementation Plan Policy and Strategic Implementation Plan. This plan, currently underway[14], aims to optimize the utilization of renewable energy sources such as solar, wind, hydro, hydrogen, and other renewable sources of energy. By incorporating these sources into the national plan, Nigeria demonstrates a commitment to the comprehensive integration of renewable energy and aligning its policies with the global transition towards sustainable practices in the energy sector.

PETROLEUM INDUSTRY ACT 2021

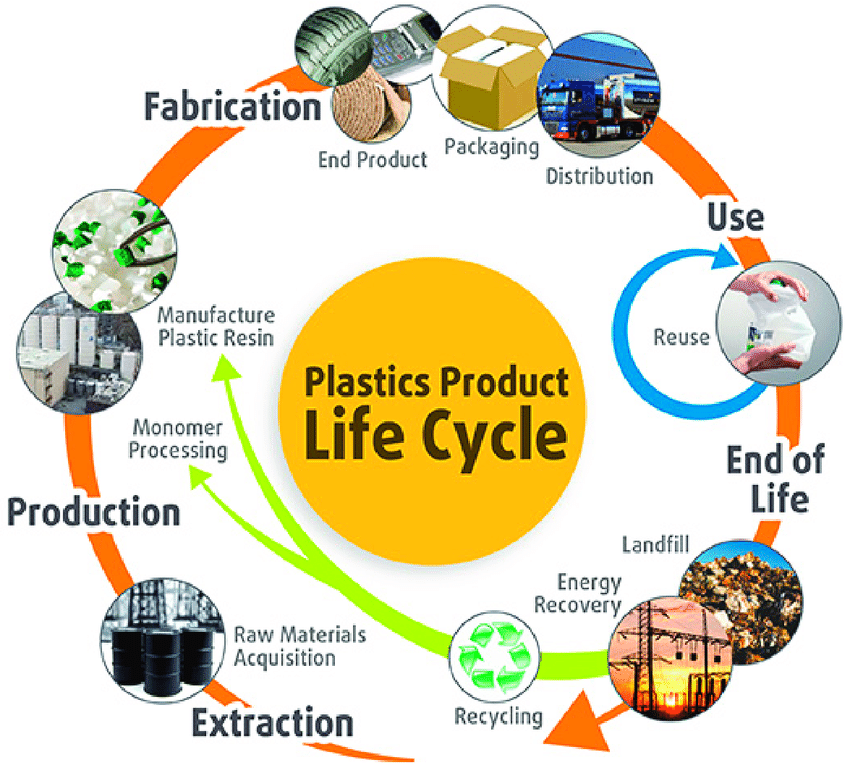

The Petroleum Industry Act (PIA), designed for the oil and gas industry, also addresses the crucial issue of gas flaring. Section 105 of the PIA explicitly prohibits the flaring or venting of natural gas, underscoring the commitment to environmental responsibility. Section 104 of the PIA establishes penalties for gas flaring, except as provided in section 104(1)(a), (b), (c) of the PIA. It is noteworthy that these provisions mark a significant step forward for the electricity sector.

The significance of this for the electricity sector lies in the acknowledgment that gas is a cleaner source of energy. Burning natural gas for energy results in fewer emissions of various air pollutants and carbon dioxide (CO2) compared to burning coal or petroleum products for an equivalent amount of energy.[15] This recognition aligns with global efforts to transition towards cleaner energy sources and reduce environmental impact.

The PIA, through penalties and the Nigerian Gas Flare Commercialisation Programme (NGFCP), imposes obligations on oil exploration companies to responsibly dispose of associated gas. This can be achieved through compliant methods, such as entering into a Gas Supply and Purchase Agreement, facilitating the lawful disposal of gas. Such agreements, when established with entities, can contribute to the production of energy for the electricity sector, promoting sustainable practices and aligning with environmental goals. The intersection of the PIA, penalties, and the NGFCP underscores the government's commitment to reducing gas flaring and advancing cleaner energy alternatives in the electricity sector.

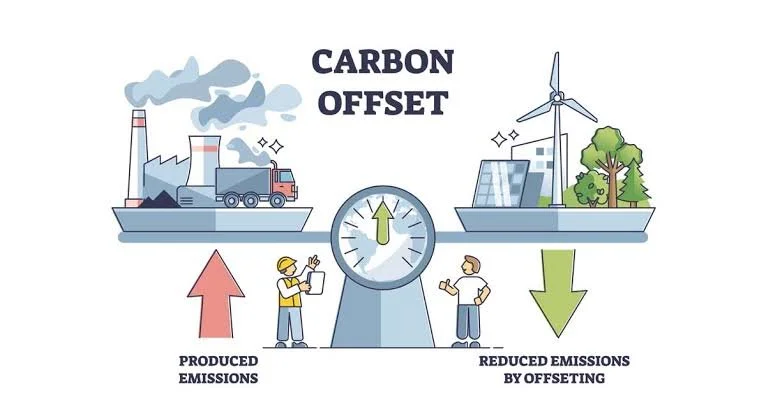

THE NIGERIA ENERGY TRANSITION PLAN

The Nigeria Energy Transition Plan (ETP) represents a crucial initiative by the government to reduce carbon emissions within the country. The ETP [16] acknowledges that emissions in the energy sector are predominantly driven by off-grid diesel/petrol generator use and on-grid gas combustion in power plants, attributed to insufficient generation capacity and grid constraints. The overarching goal of the ETP is to enhance the utilization of renewable energy sources, primarily focusing on solar energy, to address these challenges.

The key strategies outlined in the ETP include the complete elimination of diesel/petrol generators (decarbonization) and a substantial expansion of generation capacity through renewables, particularly solar energy. The plan recognizes that during the transitional phase, there will be an initial increase in gas generation to establish baseload capacity and facilitate the integration of renewable energy sources. This transitional approach is essential for meeting the energy demands while simultaneously working towards a future where renewable energy becomes the primary source.

The ETP envisions significant upgrades to central generation capacity, targeting an operational capacity of 42 GW by 2030. The plan outlines an annual increase of approximately 3 GW, including 1 GW/year for natural gas revamping, 0.8 GW/yr for new solar PV, and 0.3 GW/yr for biomass. This phased approach ensures a gradual transition to renewable energy sources while addressing the immediate need for enhanced generation capacity.

Post-2030, the ETP anticipates the deployment of centralized renewable energy (RE) solutions, with a focus on solar PV and corresponding storage, incorporating hydrogen starting in 2040. The plan outlines an ambitious target of approximately 7 GW/year by 2050 and 5 GW/year between 2050 and 2060, demonstrating a long-term commitment to sustainable and renewable energy development.

In essence, the ETP provides a comprehensive legal framework that aligns with global efforts to reduce carbon emissions, enhance renewable energy integration, and establish a sustainable energy landscape for the future.

RENEWABLE ENERGY POTENTIAL IN NIGERIA

Hydropower Potential

Nigeria's vast hydro potential remains largely untapped, with significant opportunities for development.

Assessment and Current Status

Nigeria boasts a vast untapped hydro potential of approximately 24 GW, along with a smaller hydro potential of around 3.5 GW. However, to date, the exploitation of these resources remains limited. As of 2015, the installed capacity for large hydro was only 1.9 GW, with small hydro accounting for a mere 60 megawatts.[17]

Wind Energy Potential

Nigeria possesses moderate wind potential, with notable variances across different regions.

Assessment and Current Status

Moderate wind potential exists in Nigeria, with average wind speeds ranging from 2.1 m/s to 8 m/s at a height of 10 meters. The northern region displays the highest wind speeds, exceeding 7 m/s. The International Renewable Energy Agency (“IRENA”) estimates the technical potential for wind energy at 3.2 GW, considering the utilization of only 1% of suitable land for project development. While the coastal and offshore areas remain unexplored, the southern region experiences lower wind speeds compared to the wind-rich northern region. The Federal Ministry of Power is conducting offshore wind mapping, National Renewable Energy Action Plan (“NREAP”) targets include achieving 0.17 GW of grid-connected wind capacity by 2020 and 0.8 GW by 2030.[18]

Solar Energy Potential and Challenges

Nigeria boasts abundant solar resources, offering significant opportunities for solar energy development.

Assessment and Current Status

Nigeria exhibits a high solar resource potential, with average annual global horizontal irradiation ranging between 1,600 kWh/m2 and 2,200 kWh/m2. The northern region records the highest solar irradiation, exceeding 2,000 kWh/m2. IRENA estimates the technical potential for solar photovoltaic (PV) energy at an impressive 210 GW, assuming the utilization of only 1% of suitable land for project development. Furthermore, concentrated solar power (CSP) holds substantial promise, with a potential of approximately 88.7 GW, predominantly concentrated in the northern region due to the availability of higher direct normal irradiance.[19]

Challenge [20]

Solar energy faces several challenges in Nigeria, primarily due to high initial investment costs, limited access to financing and infrastructure, inadequate policy and regulatory frameworks, and a maintenance and technical skills gap. The expensive nature of solar equipment inhibits widespread adoption, particularly in low-income areas, necessitating the development of financing mechanisms and partnerships to make solar energy more accessible. Additionally, the lack of financing options and infrastructure hampers project implementation, highlighting the need for specialized loan programs and investment in grid connectivity. Moreover, the absence of a supportive regulatory environment poses hurdles for investors, emphasizing the importance of clear policies to incentivize renewable energy and streamline operations. Lastly, addressing the technical skills gap through training programs and collaboration is crucial for the effective deployment and maintenance of solar energy systems Nigeria.[21]

Natural Gas Reserves

Nigeria's proven reserves of natural gas totalled an estimated 206.5 trillion cubic feet (Tcf) at the onset of 2023. Over the period spanning from 2012 to 2021, the average dry natural gas production in Nigeria amounted to approximately 1.5 Tcf, while dry natural gas consumption averaged 649 billion cubic feet (Bcf) within the same timeframe.[22] Despite the substantial abundance of natural gas resources in Nigeria, the efficient exploitation and application of these reserves in both industrial and domestic spheres continue to present challenges, including but not limited to: limited numbers of appropriate reservoirs conducive for gas re-injection and storage and the economics of the process, the financial commitment required for developing a major and interconnecting network of gas pipelines, and the low technology and industrial base for energy consumption in the country.

If flared gas is properly harnessed, Nigeria can produce 600,000 MT of LPG per year and generate 2.5 GW of power from new and existing Independent Power Plants to power the economy.[23]

CONCLUSION

In conclusion, this article explores the global momentum towards sustainable energy sources, emphasizing the urgency driven by climate change concerns and the imperative to reduce greenhouse gas emissions. It provides an overview of Nigeria's current energy landscape, primarily reliant on thermal and hydroelectric power, and discusses efforts to diversify energy sources through privatization and concession structures. Legislative frameworks supporting renewable energy development, such as the Electricity Act of 2023 and the Petroleum Industry Act, are examined, alongside challenges hindering the widespread adoption of renewable energy technologies. Despite promising prospects, including vast renewable energy potential in hydropower, wind, and solar energy, Nigeria must overcome obstacles such as high initial costs and inadequate infrastructure to fully embrace these alternatives. Nevertheless, with continued focus on harnessing these resources, Nigeria is poised to make significant strides towards a greener energy future.

REFERENCES

https://www.twi-global.com/technical-knowledge/faqs/renewable-energy accessed on 4 February, 2024.

https://www.twi-global.com/technical-knowledge/faqs/renewable-energy accessed on 4 February, 2024.

https://www.ren21.net/why-is-renewable-energy-important/ accessed on 4 February, 2024.

The current world population of 7.6 billion is expected to reach 8.6 billion in 2030, 9.8 billion in 2050 and 11.2 billion in 2100. https://www.un.org/en/desa/world-population-projected-reach-98-billion-2050-and-112-billion-2100 accessed on 6 February, 2024.

https://unboundsolar.com/blog/8-facts-about-renewable-energy-mandates-by-state accessed on 4 February, 2024.

https://environmentamerica.org/updates/minnesota-governor-signs-100-clean-electricity-bill/ accessed on 5 February, 2024.

https://www.weforum.org/agenda/2024/01/renewable-energy-transition-generation-eu/ accessed on 4 February, 2024.

https://www.trade.gov/country-commercial-guides/electricity-power-systems-and-renewable-energy accessed on 4 February, 2024.

https://nerc.gov.ng/index.php/home/nesi/403-generation accessed on 4 February, 2024.

Ibid

Ibid

Section 1(l) of the Electricity Act.

Section 3 of the Electricity Act.

https://independent.ng/plan-for-integrated-national-electricity-policy-underway/ accessed on 4 February, 2024.

https://www.eia.gov/energyexplained/natural-gas/natural-gas-and-the-environment.php#:~:text=Natural%20gas%20is%20a%20relatively,an%20equal%20amount%20of%20energy accessed on 5 February, 2024.

https://energytransition.gov.ng/power/ accessed on 5 February, 2024.

.https://www.nigeria-energy.com/content/dam/markets/emea/nigeria-energy/en/2023/docs/NE23-NigeriaEnergyRoadmap-Report.pdf accessed on 26 September, 2023.

Ibid

Supra

This is highlighted because solar has the highest level of user penetration in Nigeria, given the aggressive development of solar energy installation -https://link.springer.com/article/10.1007/s10668-022-02308-4 accessed on 8 February, 2024.

https://energymall.ng/challenges-of-solar-energy-in-nigeria-overcoming-barriers-to-sustainable-power/ accessed on 6 February, 2024.

https://www.eia.gov/international/analysis/country/NGA accessed on 23 September, 2023.

https://www.linkedin.com/pulse/gas-to-power-nexus-nigeria-challenges-prospects-outlook-ivie-ehanmo?utm_source=share&utm_medium=member_ios&utm_campaign=share_via accessed 6 February, 2024.